2022 Outlook

Executive Summary:

Get to know “TINA”

- The first half of 2022 is likely to be tumultuous and volatile. I believe it will provide good entry points for investing additional cash

- Stocks are still an optimal asset to own over the next few years

- Inflation should moderate in 2022

Commentary:

It’s no secret that investors are entering 2022 with a list of concerns. Truthfully, these concerns have merit and deserve attention when making portfolio decision making. Most notably:

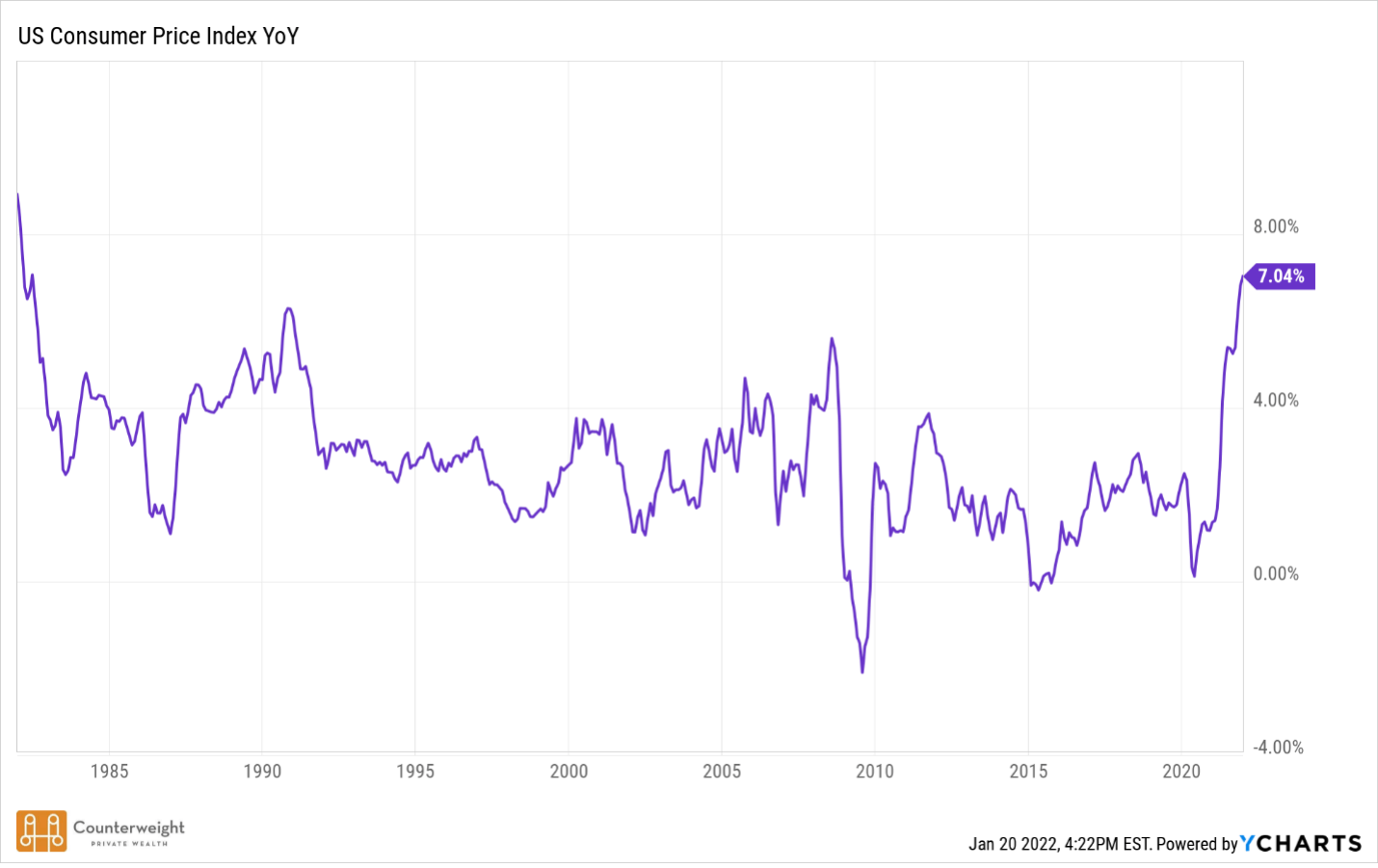

- We are currently experiencing the highest inflation in 40 years (see chart below)

- The Federal Reserve is expected to begin a cycle of interest rate increases

- The COVID-19 pandemic won’t go away completely

- Political divisiveness is high and the mid-term election season is coming quickly

- Geopolitical tensions are increasing

Throughout the past month, I have conducted considerable research in formulating thoughts for portfolio positioning as we begin 2022. Among my own data mining, I have also read through the annual market outlook reports published by many of the large financial institutions and their analysts. As expected, most are in general agreement on this year having more “muted” but positive returns than 2021. I have always been someone who detests “groupthink“, particularly as it relates to stock market and economic forecasting. Throughout my career, I have intently observed what the “experts” predict, then carefully watch what actually happens. Personally, I think predicting the 12 month return of the stock market in any given year is a waste of time and in large part… rubbish

In my view investors are better served by identifying long term trends, then evaluating factors that may impact those trends. I’ll be the first to admit, I don’t know what the value of the S&P 500 will be at the end of 2022. It may be higher than today, or it may be lower. Either way, it doesn’t really matter – let me explain.

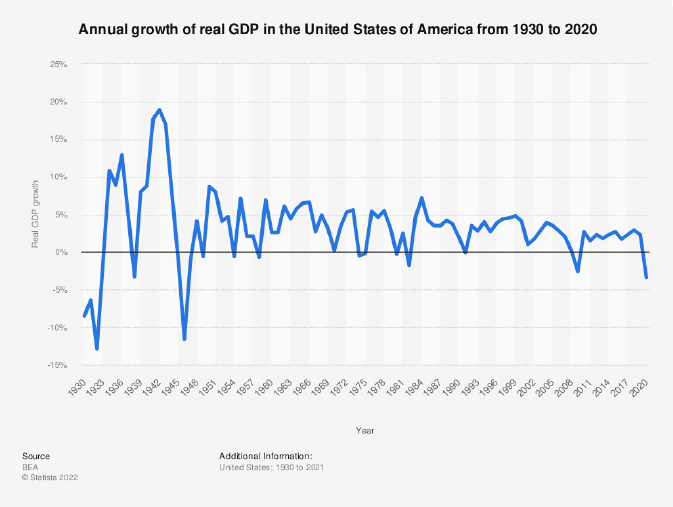

The US economy went through a recession in 2020, and it was actually quite severe. In fact, 2020 was the worst year for economic growth since 1946.

However, in present times we now have expedient (and unprecedented) stimulus and liquidity measures which can be injected into financial markets nearly instantaneously. The result, while being one of the deepest recessions on record, it was also the shortest recession in U.S. history.

I’m sure we can have hours of debate whether these types of emergency measures are healthy for long term economic sustainability. Admittedly, it is a relatively new experiment which at some point might have adverse consequences. However, as portfolio managers, we cannot be fearful about what “might” happen in some indeterminate time in the future. Instead, we must make decisions based on tangible and known factors – the most important of which is that a vast majority of the assets we manage are designed to provide retirement nest eggs for our clients. Thus, I would like to introduce you to “TINA”, whom I believe will be visiting us for a while. Who is TINA, and what does she know about investment portfolios? I’m glad you asked.

T.I.N.A. stands for …. There Is No Alternative.

Inflation is here and it’s not likely to go away. In the latest January 2022 CPI report, the most recent inflation read was an annualized 7% (CPI Release). To put that into perspective, the $1,000 you’ve had sitting in your savings account for the past year (earning 0.05% interest) is now worth $930.50. Personally, I feel there is compelling evidence that inflation will moderate throughout the year. Even if I’m correct and inflation subsides to a more modest 4% over the next year, the value of your $1,000 will have decreased to $893 over a two-year period. Therefore, to simply maintain the purchasing power of your original $1,000 you would have had to earn approximately 5,5% per year on your funds.

Meanwhile, interest rates have been declining for the past 40 years. While I don’t believe long term rates will skyrocket overnight, I do believe it’s safe to say that over the next 10 years, they will increase from today’s historically low levels. As that happens, it will put downward pressure on bond prices, particularly long bonds. Bonds can be poor investments in periods of either rising interest rates, or high inflation. Today, we have both. I believe bonds are likely to be some of the worst performing long-term investments over the next 10 years and many investors who wrongly assume that all bonds are “safe” investments, might be shocked of the losses they could experience.

So then, if neither cash nor bonds are smart investments, what does that leave investors to do? One option is investing in “real assets” such as stocks or real estate. Since the real estate market is highly leveraged (i.e. most real estate is financed through lending which is sensitive to interest rates), in my view that leaves a more compelling option…. stocks.

Does this mean stocks are simply the lesser of all evils? No. In fact, I feel there are very convincing reasons why the stock market is likely to go higher over the next few years. To save you from reading another dissertation, here is my summary:

- Economic growth is strong and robust

- Corporate profit margins and earnings growth are extremely healthy

- The consumer is very strong and there are large amounts of pent-up demand

- Inflation should moderate in the back half of 2022

- Historical stock market returns are good during periods of negative “real” rates

In my view near term stock market returns will largely be dependent on Federal Reserve action. If they can effectively thread the needle and remove the immense amount of “emergency” liquidity without moving too quickly and slowing economic growth, I believe markets are still poised to go higher due to strong economic fundamentals. For the record, I feel that the first half of 2022 might be tumultuous. The market has not experienced a 10% correction in over a year and investors have become a bit complacent.

So, in conclusion, while we may have a rough and rocky start to 2022, I encourage you to invest with confidence and stick to the plan. Disciplined and patient investors will likely be rewarded.