What Does Recent Market Volatility Mean For You? – 3 Suggestions to Help You Stay Focused

September 13, 2022

|Market volatility has increased again and I’m sensing more trepidation among investors and our clients. I believe many are wondering how bad things will get and whether they should be more defensive in their portfolios. I plan to share my thoughts, but first, a quick recap on how we got here. Back in our 2022 Outlook piece, I tried to sum up our projections for the coming year in the following bullet points (quoted from that article).

- The first half of 2022 is likely to be tumultuous and volatile. I believe it will provide good entry points for investing additional cash

- Stocks are still an optimal asset to own over the next few years

- Inflation should moderate in 2022

The first point has obviously come to fruition, and it is healthy for markets to go through corrections to flush out excesses built during bull markets. Having said that, are the last two points still valid? Are stocks still the optimal asset to own over the next few years? Will inflation moderate in 2022? In short, I believe the answer is yes.

There are many crosscurrents going on right now in financial markets. In my opinion, too many times the media, financial institutions, and financial advisors (including myself) try to describe the intricacies of all the financial variables which impact markets. While these concepts can be very complex, most don’t have to be. In fact, I believe right now (possibly more than any other time in my career) the current situation can be summed up in simply two words . . . Federal Reserve.

In July’s article, I explained the path towards a recovery in the stock market. For stocks to recover, the first domino to fall must be inflation. Even though we had just come off a blistering 9.1% June inflation reading, I felt confident it was probably the peak. I wrote that:

“It is reasonable to believe that we may have seen the peak inflation report and things should be improving going forward. If so, and subsequently the Federal Reserve shifts from an “aggressive” approach to a “measured” approach on interest rates, it’s probable that markets will begin to turn higher in the second half of 2022.”

That article was printed on July 15 and over the following four weeks, the S&P 500 rallied over 11%. All seemed to be going as planned, right? Well, yes and no.

On August 26, the chairman of the Federal Reserve, Jerome Powell, gave a speech in which he seemed to double down on an aggressive interest rate policy to combat inflation. Markets were hoping his tone may soften, but Powell was quoted as saying that fighting inflation will “cause some pain” because they were not going to let the “far greater pain” of inflation sting the economy. Since that speech, there have been significant declines in stock prices nearly every day.

So, where does that leave us? Are we headed much lower before the pain will end? Well, in my view, Powell felt he needed to present a hardline approach to prevent a situation where equity markets would continue to rally, thereby causing inflationary pressures to be harder to contain. The bottom line, I believe he’s posturing to be much more aggressive than what the Fed may actually need to do over time.

How can this be? Well, there are tangible underlying reasons that inflation may retreat more quickly than everyone expects. I realize that’s not the popular opinion and it may be hard to believe, but if you look at hard data (ISM prices, gasoline, commodities, etc.) it seems probable. After all, many times the “consensus” opinion turns out to be wrong. For example, it was only a few months ago that oil prices were supposed to be $140/barrel and gasoline near $5/gallon right now. Here’s a June CNN article where Goldman Sachs predicted how bad things would get. Yet here we are through peak summer demand (with an ongoing war in Ukraine) and oil is $83/barrel. You may not realize it, but that’s less than at the beginning of the Russian invasion! If we are in an environment of unconstrained inflation, it’s not likely that gas prices would drop 25% over a three-month period “peak demand” season.

Here’s my point, market corrections take time to bottom out and we shouldn’t expect markets race to new all-time highs anytime soon. There’s likely going to be some back-and-forth sideways movement for a while. At times, it will feel like things are improving. Other times, it will feel like things are getting worse. But stay disciplined, knowing that these things must take place.

Here are 3 suggestions to help you stay focused:

1.Be careful what you read, watch, and listen to. – In bad market conditions, people come out of the woodwork to forecast doom, gloom, and catastrophe. It’s like clockwork and has happened throughout every market cycle in my career. If you listen to these prognosticators, you’ll find yourself confused, terrified, and unable to think clearly. On average, I get one or two emails a month from someone asking me what I think about one of these “experts”. Inevitably, they make claims that the economy will collapse, stocks will crash, and everyone’s wealth will be wiped out. When you dig deeper you find they have a “survival guide” or something else to sell to capitalize on your fear. Don’t fall for it.

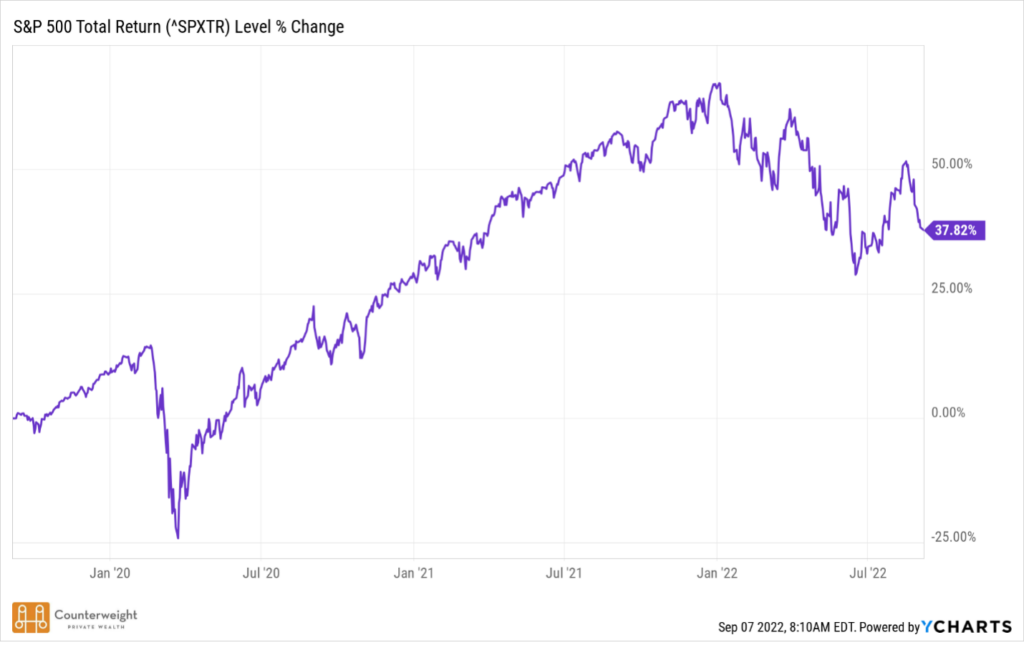

2.Don’t cling to high water marks. – This one is hard, trust me I’m guilty of it too. As humans, we easily cling to the moment our investments reached their absolute maximum value to calculate how much we’ve lost. This is not a good practice, and we must retrain our thinking. You need to realize that those “high water marks” might have been artificially high, just like low water marks many times are artificially low. Instead, look at how your wealth has grown over a longer period. For example, if 3 years ago I gave you a high likelihood your investments would be worth 37% more over the next three years, you’d be thrilled. It’s hard to imagine anyone concluding that was a terrible investment and should be avoided. Yet, over the last 3 years that’s exactly what has happened (see attached chart). Even through the COVID-19 pandemic and the most recent downturn, the S&P 500 is over 37% higher than exactly three years ago.

3.Resist the impulsive urge to change – We’ve all heard the saying “Don’t just stand there, do something!” Well, in most instances, successful investing involves “Don’t just do something, stand there!” All the market gyrations of the last year are still well within the parameters of normal market cycles. Historically speaking, we’ve been through these types of corrections many times before and while the conditions are always different, nothing in the last year has caused me to believe we should abandon our long-term strategy. I highlighted this during our last webinar and gave some historical context to bear markets. If you’re interested in watching that brief video, click here.

If you are still in your working years, staying invested for the long haul may be easier than when you stop working. For those of you already retired, I realize the weight of down markets can be paralyzing. You may find yourself asking questions like “Should I take out less from my investments until things improve?” Or “I can’t afford to lose everything, should I get more conservative?” If you are struggling with these fears, I encourage you to reach out to us. We are happy to take another hard look at your situation and help you come to a meaningful conclusion. When we put together your retirement income plan, our team goes through various stress tests to minimize the risk of bad markets having a detrimental impact. Most of the time, the answer is to stay committed to your strategy. Even so, we are happy to take a fresh look just to be sure.

Someone once said, “The days are long, but the years are short.” I believe the reason this seems true is because we humans tend to fret over day-to-day things. However, if we were to look out over the years, it’s amazing how far we have come. That’s the best advice I can give right now. The years are short, so don’t fret over every movement of the market day to day. All it will do is give you heartburn and a headache. We’re here to keep you focused on the right things so that you can have confidence in your future. Live fully, live purposefully, and stay focused on what really matters. In time, the market noise of 2022 will be a distant memory, just like all the others.

Counterweight Private Wealth is a Registered Investment Advisor (RIA) with the Securities and Exchange Commission (SEC) with its principal offices in Raleigh, NC and Wilmington, NC. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Counterweight Private Wealth only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Counterweight Private Wealth’s current written disclosure brochure filed with the SEC which discusses among other things, its business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services. All investing involves risk, including the possible loss of principal. Statements of future expectations, estimate, projections, and other forward-looking statements are based on available information and author’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Past performance of various investment strategies, sectors, vehicles and indices are not indicative of future results.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed to be reliable, are not necessarily all inclusive, and are not guaranteed as to its accuracy. This material is provided for educational purposes only and does not constitute investment, legal, tax, or accounting advice. Please consult with a qualified professional for this type of advice for your own unique situation.