Decoding Medicare – A Playbook for Creating Optimal Retirement Healthcare [Webinar Summary]

April 10, 2024

|In this session, Nancy Schwartz, Independent Licensed Medicare Broker at Smart Senior Healthcare, provides an overview of Medicare and how to maximize your healthcare options in retirement.

Specifically, she shares:

- WHEN to enroll in Medicare

- WHAT are the parts and plans of Medicare

- HOW to find the plan that fits your needs and budget.

For more information or to reach out to Nancy directly, visit: www.smartmedicare.com

Check out the summary of the webinar below, organized by key sections & timestamps:

- Introduction (0:00)

- Nancy Schwartz Credentials (7:27)

- Common Burning Questions (8:45)

- Why People Struggle with Medicare Decisions (10:47)

- When to Enroll (13:20)

- Criteria for Small Group vs Large Group Employer(18:01)

- Original Medicare: Part A + B (26:11)

- How to Fill the Gaps for What Medicare Doesn’t Cover (29:50)

- What is Medicare Part D? (33:06)

- Scenarios for Coverage (39:15)

- Live Q&A (44:58)

Introduction (0:00)

- Nick Murphy opens the webinar by introducing himself from Counterweight Private Wealth, highlighting their focus on retirement planning and the transitions that come with it, including Medicare decisions.

- Nick emphasizes the session’s goal to provide educational content on Medicare, advising against making decisions solely based on the webinar.

- Nick mentions Medicare’s complexity and the importance of expert guidance to navigate it effectively.

Nancy Schwartz Credentials (7:27)

- Our speaker Nancy Schwartz shares her background: over 15 years of caregiving experience, with expertise in Medicare based on personal and professional experiences.

- Nancy highlights her passion for helping individuals find suitable Medicare coverage, inspired by personal caregiving for her father.

- Nancy notes her success in assisting numerous people with Medicare enrollment, underlining her commitment and knowledge in the field.

Common Burning Medicare Questions (8:45)

- Nancy addresses common misconceptions about Medicare, such as enrollment obligations and coverage details.

- She stresses the critical nature of making informed Medicare decisions to avoid penalties and ensure proper coverage.

- She acknowledges the challenges posed by the system’s complexity, advocating for professional guidance.

Why People Struggle with Medicare Decisions (10:47)

- Nancy discusses how the abundance of information and its complexity make Medicare decisions challenging for many.

- She explains how the illogical aspects of the Medicare system contribute to confusion and poor decision-making.

- She points out that the overwhelming nature of the information can lead to procrastination or inadequate decisions.

When to Enroll (13:20)

- Nancy details the specific periods and conditions under which individuals need to enroll in Medicare to avoid penalties.

- She emphasizes the consequences of late enrollment, including lifelong penalties and coverage gaps.

- She explains the various scenarios that affect when an individual should enroll in Medicare, based on retirement status and employer size (covered in depth in next section).

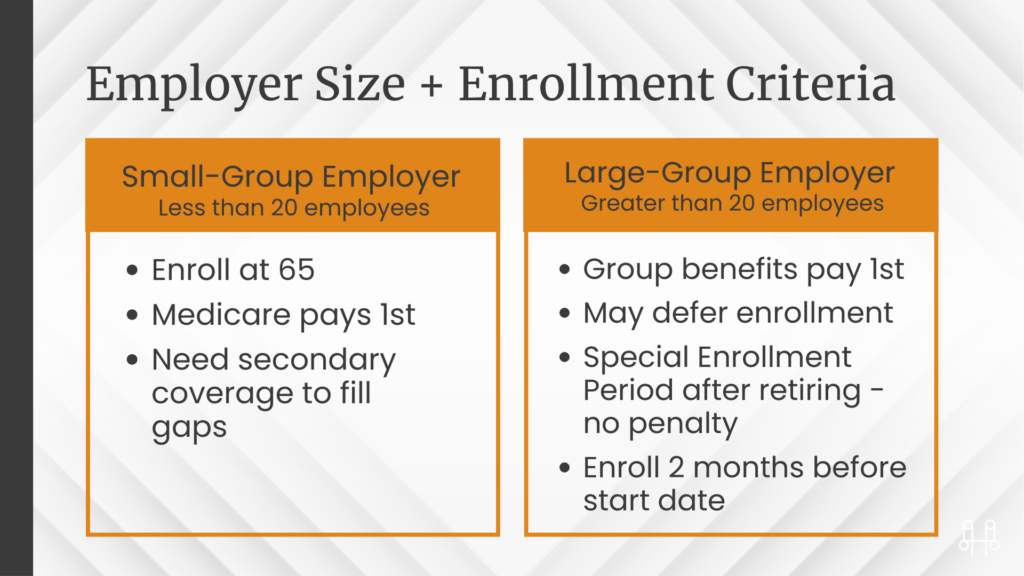

Criteria for Small Group vs Large Group Employer (18:01)

- Nancy reviews how the size of an employer affects Medicare enrollment criteria, particularly the distinction between small and large groups.

- She highlights how employer-provided insurance interacts with Medicare, depending on the size of the employer.

- She provides guidance on how individuals should approach Medicare enrollment based on their current employment and insurance status.

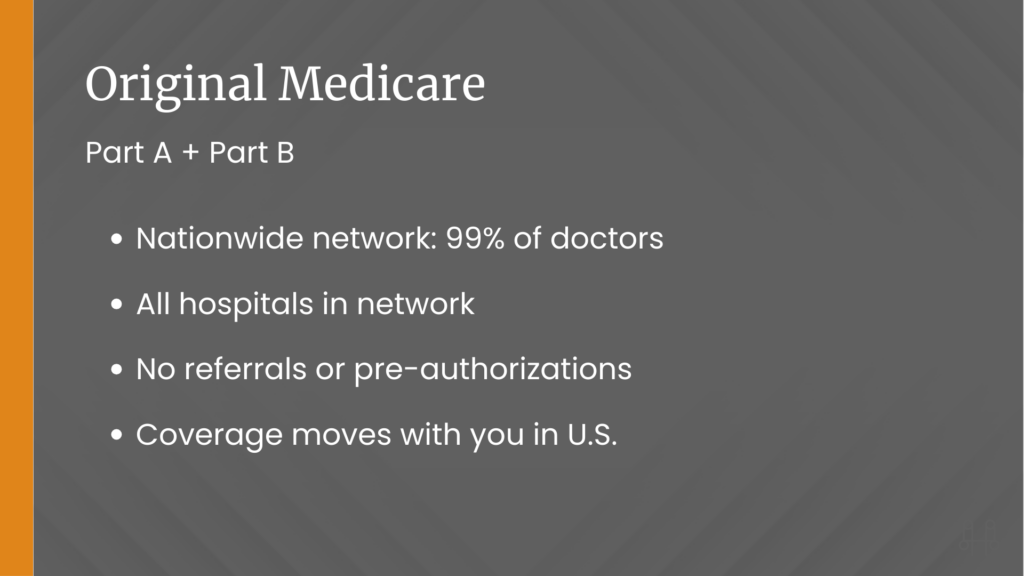

Original Medicare: Part A + B (26:11)

- Nancy breaks down the coverage provided by Part A and B, including hospital insurance and medical insurance.

- Nancy details cost: the premiums, deductibles, and co-pays involved in Part A and B, highlighting financial considerations.

- Income-Related Monthly Adjustment Amount (IRMAA): In this section, she introduces the concept of IRMAA, explaining how Part B premiums can vary based on income.

- Financial Planning for Medicare: She urges the importance of considering Medicare costs in retirement planning, particularly the variable nature of Part B premiums.

- Nancy explains the significance of enrolling in Part A and B at the appropriate time to avoid unnecessary financial penalties.

How to Fill the Gaps for What Medicare Doesn’t Cover (29:50)

- Nancy identifies the healthcare services and items not covered by Original Medicare, underlining the need for additional coverage.

- She compares the benefits and drawbacks of Medicare Supplements (Medigap) and Medicare Advantage plans as options to fill coverage gaps.

- She offers strategies for selecting the most appropriate supplemental coverage based on individual healthcare needs and preferences.

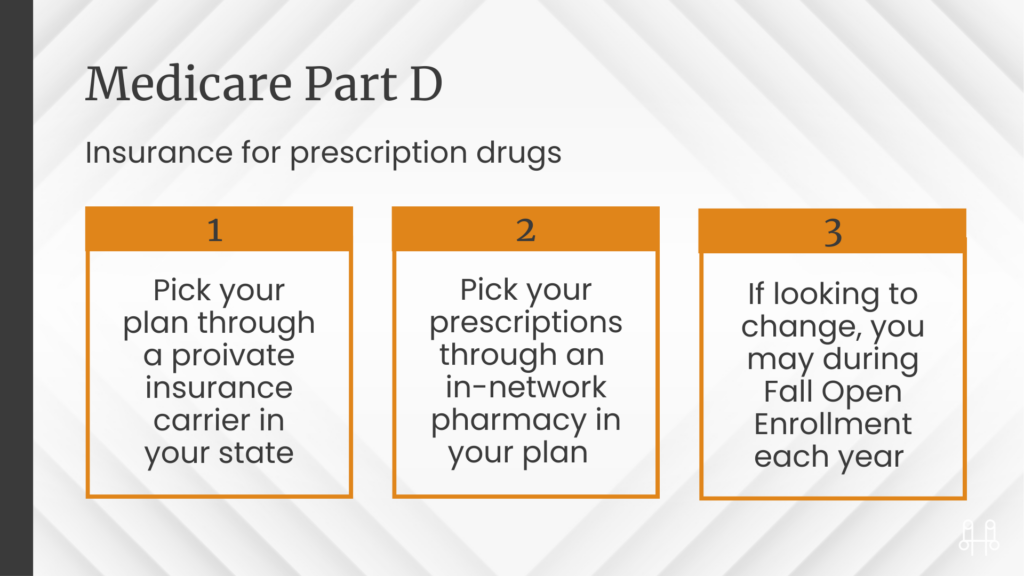

What is Medicare Part D? (33:06)

- Nancy explains Medicare Part D, focusing on prescription drug coverage and its importance in comprehensive healthcare planning.

- She discusses the factors to consider when choosing a Part D plan, including medication needs and cost considerations.

- She highlights the importance of reviewing Part D plans annually to ensure they continue to meet medication needs effectively.

Scenarios for Coverage (39:15)

- In this part of the webinar, Nancy presents various coverage scenarios to illustrate how different Medicare plans can cater to individual healthcare needs and preferences.

- She addresses the special considerations for individuals with chronic conditions in choosing between Medicare Supplements and Advantage plans.

- She explores the impact of budget constraints on selecting a Medicare plan, emphasizing the trade-offs between comprehensive coverage and cost.

Live Q&A (44:58)

Nick and Nancy take live Medicare questions from the audience.

- Does an employer’s High Deductible Health Plan (HDHP) qualify as comparable coverage for deferred Medicare enrollment?

- Should you enroll in Medicare 3 months before your 65th birthday, even if covered by a spouse’s employer insurance?

- How does Medicare Advantage work if Medicare is privatized? Do Advantage plan enrollees benefit from their contributions to Social Security and Medicare taxes?

- Can you review the importance of the initial signup free-look period where a plan does not do a comprehensive review of one’s medical file?

- Do any Part D plans cover the majority of costs for tier 4 drugs?

- For individuals over 65 who are part of a large employer group plan and may have employment gaps or switch jobs, how does this affect their Medicare enrollment or potential penalties?

- How does opting out of Social Security affect Medicare eligibility and costs, especially for those who may not have contributed enough to qualify for premium-free Part A?

Counterweight Private Wealth is a Registered Investment Advisor (RIA) with the Securities and Exchange Commission (SEC) with its principal offices in Raleigh, NC and Wilmington, NC. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Counterweight Private Wealth only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Counterweight Private Wealth’s current written disclosure brochure filed with the SEC which discusses among other things, its business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services. All investing involves risk, including the possible loss of principal. Statements of future expectations, estimate, projections, and other forward-looking statements are based on available information and author’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Past performance of various investment strategies, sectors, vehicles and indices are not indicative of future results.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed to be reliable, are not necessarily all inclusive, and are not guaranteed as to its accuracy. This material is provided for educational purposes only and does not constitute investment, legal, tax, or accounting advice. Please consult with a qualified professional for this type of advice for your own unique situation.