Should My Spouse Claim Early? Understanding Social Security Spousal Benefits

July 22, 2023

|We’ve recently had a few clients inquire about the rules for claiming a Social Security Spousal benefit. For example:

“I am nearing age 62, married, and the lower earner and plan to start drawing my Social Security retirement benefit right away. I feel it’s best to start drawing my benefit at age 62, then bump up to ½ of my husband’s benefit at age 67 when he claims at age 67. This allows me to draw on my record for 5 years, then I can switch to the spousal benefit at 67 and draw ½ of my husband’s benefit. It seems like a win-win; do you foresee any issues with this strategy?”

We often receive this type of question, and it is one of the many misunderstood claiming strategies people consider. First, it is important to define a couple of key terms used to calculate a spousal benefit.

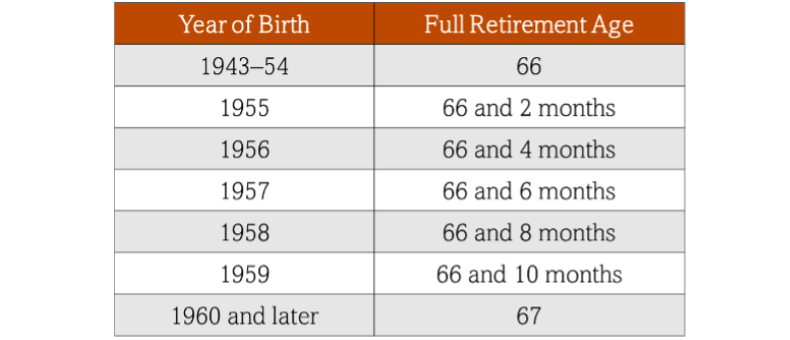

Full Retirement Age (FRA): Age at which an individual may be entitled to their full or unreduced benefits. The chart below identifies your FRA based on when you were born.

Primary Insurance Amount (PIA): This is the dollar amount an individual will receive when they reach FRA, and is determined from one’s work history and taxes paid into the Social Security program. To obtain your estimated PIA, log in or create an account at: www.ssa.gov/myaccount.

Spousal Benefit: If married, the lower earning spouse may be eligible for a spousal benefit based on the higher-earner’s work record. If you claim this benefit at your full retirement age, the benefit will be 50% of your spouse’s PIA. Here are some additional rules about spousal benefits:

- Your spouse must have filed for their benefit in order for you to receive a spousal benefit.

- A spousal benefit is comprised of 2 parts: 1) your own benefit based on your work history if eligible and 2) a spousal offset. The scenarios at the end will help clarify this calculation.

- If you claim your spousal benefit at FRA, you will receive ½ of your spouse’s PIA regardless of when your spouse claims. I.e. a higher earning spouse claiming his/her reduced benefit at age 62 will not affect a spousal benefit claimed at FRA. A higher earning spouse claiming early would, however, affect Survivor benefits, but that is a topic for a future blog.

- Deferring a spousal benefit beyond FRA does not increase this benefit. Only an individual’s retirement benefit can earn the 8% per year delayed retirement credits between FRA and age 70. Once again, a topic for a future blog.

- If you claim a spousal benefit prior to your FRA, the benefit will be reduced. A spouse can choose to claim the spousal benefit as early as age 62 (earlier if caring for a child who is under 16 or disabled), but doing so would result in a benefit that’s 35% the worker’s primary insurance amount instead of the 50% one would receive at FRA.

- If a lower earning spouse’s PIA is more than ½ of the higher earning spouse’s PIA, the lower earning spouse will not receive a spousal benefit, but rather, would only receive their own benefit.

- A couple must be legally married (as per state determined eligibility) at least one year in order for a spouse to be eligible for spousal benefits. The spousal benefit stops upon termination of marriage.

- Both spouses cannot claim a spousal benefit at the same time; thus, eliminating the ‘File and Suspend’ strategy which allowed individuals to receive one type of benefit while at the same time earning a bonus for delaying the other benefit*. The Bipartisan Budget Act of 2015 implemented ‘deemed filing,’, which stipulates when you file for Social Security you are “deemed” to be filing for all the benefits you are eligible for (your own or spousal) and will receive the higher of two. Of note, deemed filing applies to retirement and not survivor benefits, and one should consult an advisor about coordination of survivor benefits.

- *Very few individuals are still grandfathered to implement the ‘File and Suspend’ strategy. Only those born on or prior to January 1, 1954 and who have not already claimed are still eligible to execute this strategy.

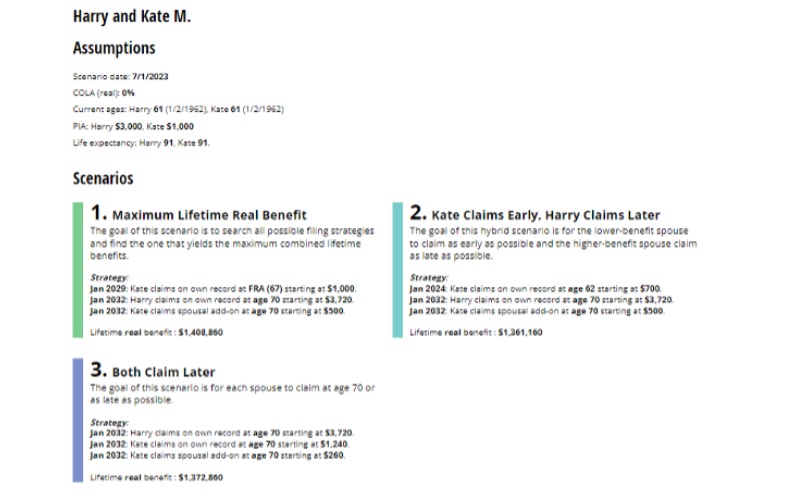

Here are scenarios demonstrating the spousal benefit and the impact of:

- The lower earning spouse claiming at FRA, higher earning spouse at age 70

- The lower earning spouse claiming prior to FRA at age 62, higher earner at age 70

- The lower earning spouse claiming at age 70, higher earner at age 70

While Social Security benefits have a Cost-of-Living Adjustment (COLA) each year, for simplification of these scenarios, we will assume no COLA. Our couple is Harry (age 61) with a PIA of $3,000, and Kate (age 61) with a PIA of $1,000.

Let’s run through how the spousal benefit is calculated for Kate, the lower earning spouse:

Kate’s total spousal benefit at FRA (67) = ½ Harry’s PIA (.5 x $3,000) = $1,500

As mentioned above, the Spousal Benefit is comprised of 2 parts: first, the lower earning spouse’s benefit, plus a “spousal offset/add on” is added to Kate’s benefit once the higher earning spouse (Harry) claims and ‘unlocks’ the door for the “spousal offset/add on” portion of the benefit to begin. To determine the spousal offset for Kate from ages 62 to FRA, we subtract Kate’s PIA from ½ of Harry’s PIA, resulting in a $500 Spousal Offset, and the Spousal Benefit at Kate’s FRA looks like this: Kate’s PIA ($1,000) + Spousal Offset ($500) = $1,500. We will use this $500 spousal offset figure for scenarios 1 and 2.

Scenario 1 – Kate claims at FRA (67), Harry claims at age 70. Here is an illustration of Kate’s benefits:

- Age 67 $1,000 (Kate claims at FRA, no reduction in benefit)

- Age 68 $1,000

- Age 69 $1,000

- Age 70 $1,500 (Kate’s benefit $1,000 + spousal offset $500 = $1,500)*

- Age 71 $1,500

- Age 72 $1,500

- Age 73 $1,500

*Harry claiming at age 70 unlocks the door for Kate to receive spousal offset

The benefit of Kate claiming at FRA is she will receive the full spousal benefit. This results in the highest lifetime payout for Kate and Harry assuming they both live to age 91 (reference scenario comparison at end of post).

Scenario 2 – Kate claims early at age 62, Harry claims at age 70. Here is an illustration of Kate’s benefits:

- Age 62 $700 (Kate’s benefit is reduced by 30% as a result of claiming early at age 62)

- Age 63 $700

- Age 64 $700

- Age 65 $700

- Age 66 $700

- Age 67 $700

- Age 68 $700

- Age 69 $700

- Age 70 $1,200 (Kate’s reduced benefit + spousal offset $500 = $1,200)*

- Age 71 $1,200

- Age 72 $1,200

- Age 73 $1,200

*Harry claiming at age 70 unlocks the door for Kate to receive spousal offset

As demonstrated, since Kate claimed prior to her FRA, her benefit is permanently reduced. This is contrary to popular belief, in which many people incorrectly surmise Kate’s benefit will automatically be adjusted to ½ of Harry’s PIA once Harry starts his benefit and unlocks the door for Kate to receive the spousal offset.

Scenario 3 – Kate claims at age 70, Harry claims at age 70. Here is an illustration of Kate’s benefits:

- Age 67

- Age 68

- Age 69

- Age 70 $1,500 (Kate’s benefit $1,240 + spousal offset $260 = $1,500)*

- Age 71 $1,500

- Age 72 $1,500

- Age 73 $1,500

*Harry claiming at age 70 unlocks the door for Kate to receive spousal offset

This scenario demonstrates that once Kate reaches FRA, 100% of her spousal benefit is available and there is no benefit to Kate claiming past FRA. Although Kate does in fact earn delayed retirement credits on her individual benefit at 8% per year from FRA to age 70 (24% increase in her PIA) and her portion of the spousal benefit is $1,240 ($1000 x 1.24), the spousal offset is then reduced to $260 to bring her up to ½ of Harry’s PIA ($1,500). Seems unfair, but this is how the program calculates the spousal benefit.

Scenario Comparison:

Navigating social security can be confusing, but you don’t have to do it alone. Our team at Counterweight is here to help clear up any questions and find your optimal claiming scenario.

Counterweight Private Wealth is a Registered Investment Advisor (RIA) with the Securities and Exchange Commission (SEC) with its principal offices in Raleigh, NC and Wilmington, NC. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Counterweight Private Wealth only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Counterweight Private Wealth’s current written disclosure brochure filed with the SEC which discusses among other things, its business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services. All investing involves risk, including the possible loss of principal. Statements of future expectations, estimate, projections, and other forward-looking statements are based on available information and author’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Past performance of various investment strategies, sectors, vehicles and indices are not indicative of future results.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed to be reliable, are not necessarily all inclusive, and are not guaranteed as to its accuracy. This material is provided for educational purposes only and does not constitute investment, legal, tax, or accounting advice. Please consult with a qualified professional for this type of advice for your own unique situation.